General Ledger System

Important features and characteristics :

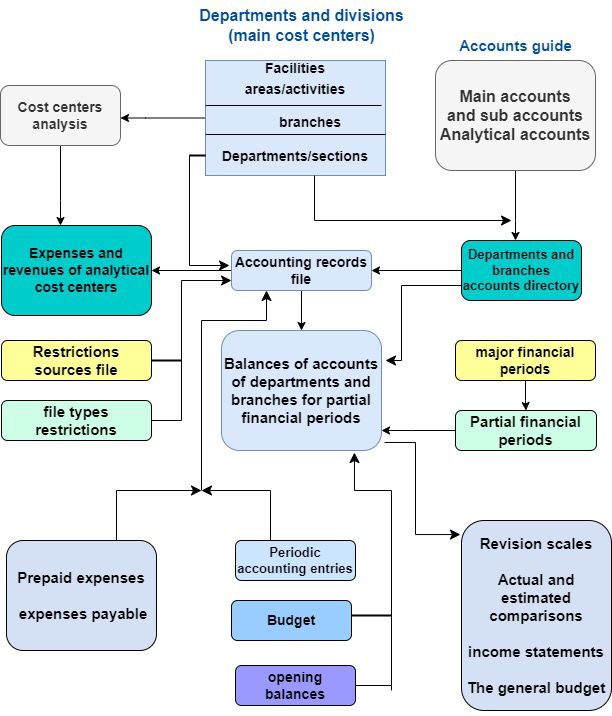

- The unified Chart Of Accounts is easily linked to the main cost centers represented by a group of companies and a group of activities, regions, branches, departments and divisions at the level of each company.

- The system provides the ability to define analytical cost centers under the department or department level, as well as analytical cost centers under any of the accounts (expenses or revenues).

- The existence of a set of mechanisms that enable the ordinary user to design and create unlimited accounting reports and keep them in the system permanently in order to refer to them by printing them when needed, without seeking the help of any specialist. The most important of these reports are income statements and balance sheets as a sample of the types of these reports.

- The system contains the possibility of issuing income statements at the levels of analytical cost centers, then departments, departments, branches, regions, activities, companies, and finally the holding company or group. The system also provides the ability to issue balance sheets at the levels of the branch, activity, company, and group.

- The General Ledger system automatically records and retains all incoming invoices or expenses paid in advance from all other systems (human resources, rental contracts, insurance contracts of all kinds, maintenance contracts, subscription contracts, and any source in which it is necessary to disburse amounts in advance) in order to distribute them to The period of each expense or contract depends on the number of days, and the actual expenses are posted and distributed over the months for each department, division, or analytical cost center. Through this system, we make sure to charge each analytical cost center for each partial financial period (monthly).

- The General Ledger system automatically records and retains all invoices issued or revenues received in advance from all other systems (project management system, car rental system, real estate or machinery rental contracts, and any source in which it is necessary to receive amounts in advance) in order to distribute them over the period of each revenue. Or a contract according to the number of days, and the actual revenues are transferred and distributed over the months for each department, division, or analytical cost center. Through this system, we are careful to distribute the revenues to each analytical cost center for each partial financial period (monthly).

- Ease of linking and then accessing any system and any movement in the system that issues the accounting entry automatically through the accounting entry data, as well as easy access to the accounting entry from the transaction data (for all systems) that issue the accounting entry.

- The system provides recording of the estimated budget in public accounting and monitoring of violations of it from all other systems.

- Upon the client’s request, we provide the service of forming the client’s accounting guide and linking it to the rest of the systems.

- The system provides our customers with the ability to open Hijri or Gregorian financial periods.

The distinctive and positive points of financial systems

- The system provides the ability to issue any transaction in all systems that make up the central system, involving two companies on the same database. In this case, the accounts for this transaction are affected by the two companies at the same time. This transaction also produces two accounting entries in the general accounting system, an accounting entry for each company in the middle. In each entry there is a current account for the sister companies, and this feature is very important for clients who have several companies on the same databases, or several activities for each company to extract a balance sheet at the level of each activity in addition to the company’s budget.

- The system provides the possibility of issuing any transaction in all the systems that make up the central system, the two ends of which are two branches of the same company on the same database. In this case, the accounts for this transaction are affected at each branch at the same time. This transaction also produces two accounting entries in the general accounting system. An accounting entry for each branch mediates each current account entry for the department and the branches. This feature is very important for clients who have several branches for each company on the same databases. This feature also enables the client to edit trial balances and a general budget for each branch, in addition to the ability to edit income statements for each. Branch as well as for each department or section.

- The general accounting system contains a list of programs for estimated budgets for accounting directory accounts and at the level of cost centers for each account.

- The public accounting system contains a list of programs that provide the accountant or user with the ability to design and print a new report from the final financial reports without seeking the help of the entity that supplied the system or a specialized programmer to create a new report and link it to the system. Each report has its own items and each item is linked to the accounts whose balances flow into this. Item. These programs also provide the accountant with the ability to modify any report or add hundreds of reports as needed.

- The General Ledger system contains a list of programs through which the opening balances and new accounts for expense accounts linked to prepaid or accrued expense accounts are defined. Each record of this type of record contains the beginning and end of the period for the expense, its amount, and the cost centers associated with this type of expense. Accordingly, the system automatically edits records of expenses that pertain to each monthly financial period according to the number of days in the month. These records are automatically recorded through rental contracts, maintenance contracts, employee residency records, or medical insurance records for each employee. The most important goal of this list of programs is to maintain… Extracting accurate monthly income statements as well as uploading all types of expenses to the cost centers for each employee, mechanism, project, etc.

- The General Ledger system contains a list of programs through which the opening balances and new accounts for revenue accounts linked to revenue accounts received in advance or due are defined. Each record of this type of record contains the beginning and end of the period for the revenue, its amount, and the cost centers associated with this type. Accordingly, the system automatically edits the actual revenue entries that pertain to each monthly financial period according to the number of days in the month. These records are automatically recorded through leasing contracts, maintenance contracts, or project client contracts. The most important goal of this list of programs is to maintain the extraction of monthly income statements. Accurate, as well as uploading all types of revenues to the cost centers for each contract or project, etc.

- The system automatically edits all textual explanations for all financial transactions in both languages without the user having to enter any text characters to explain the transaction or the accounting entry resulting from it. This feature greatly speeds up the entry of transactions, and also reduces spelling errors in reports addressed to customers, suppliers, or official bodies, and finally unifies the explanations. The text is sufficient in its meanings and does not leave the user to work hard.

- The system contains dozens of screens, quick search programs (Search Engines), and top-to-bottom search screens (Drill Down) for each system. These screens are rarely found in competing systems, and if they do exist, they are often on a very narrow scale in terms of number or comprehensiveness and coverage of all systems. .

- The system provides protection against mismatches in financial balances by comparing them between the general accounts and the origin of the movement in the side systems, which affects their restrictions on the general accounts. For example, the system prevents the user from entering the screen for editing an extract, invoice, or receiving a check if this screen does not It is originally linked to the accounting guide, even if this screen is within the powers of the same user.

General Data Flow