Cash Management System

(Management of bank accounts, funds and covenants)

Important Features :

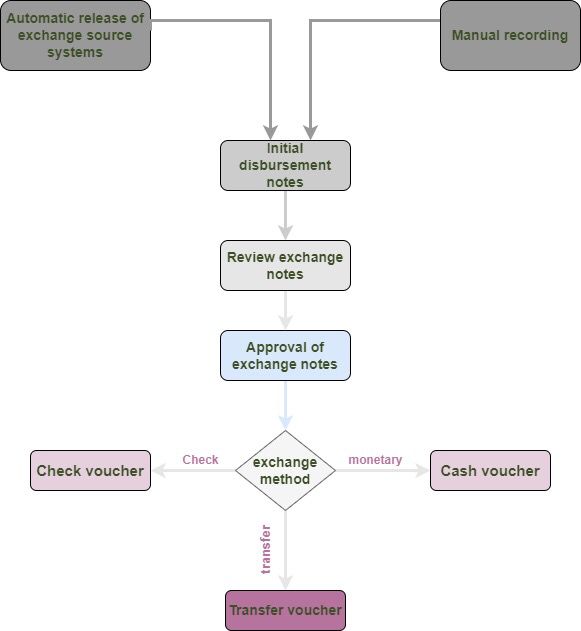

- Monitoring the balances of the facility’s main funds, employees’ trusts, and all types of bank accounts.

- Providing the ability to edit receipt vouchers, cash vouchers of all types, checks, bank transfers, and credit card transactions for all other system transactions related to receipt or disbursement transactions through this system.

- Monitoring actual and expected receipts, whether entered manually or posted automatically through the deferred invoice program, maintenance contracts, or rental contracts, for example.

- Monitoring actual and expected payments, whether entered manually or automatically posted through the credits and documentary collections program, receipt of goods shipments, payroll programs, and monthly dues for employees.

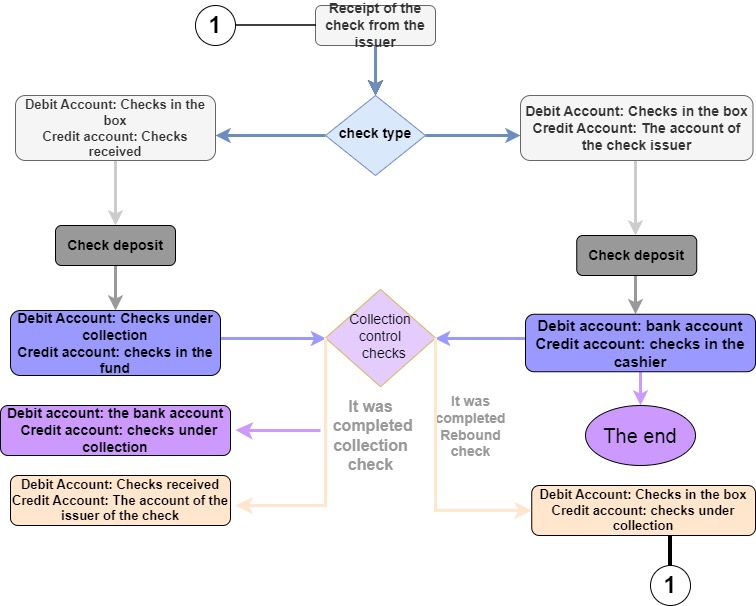

- Follow up on checks received from their sources, monitor their collection, and make appropriate accounting entries for each related movement.

- Monitoring prepaid receipts (the Godfathers), linking them to the invoices issued, and processing their restrictions.

- Providing the ability to conduct and edit debit and credit financial notices on the account balances of the main funds, employee trusts, and bank accounts of all types specific to the facility.

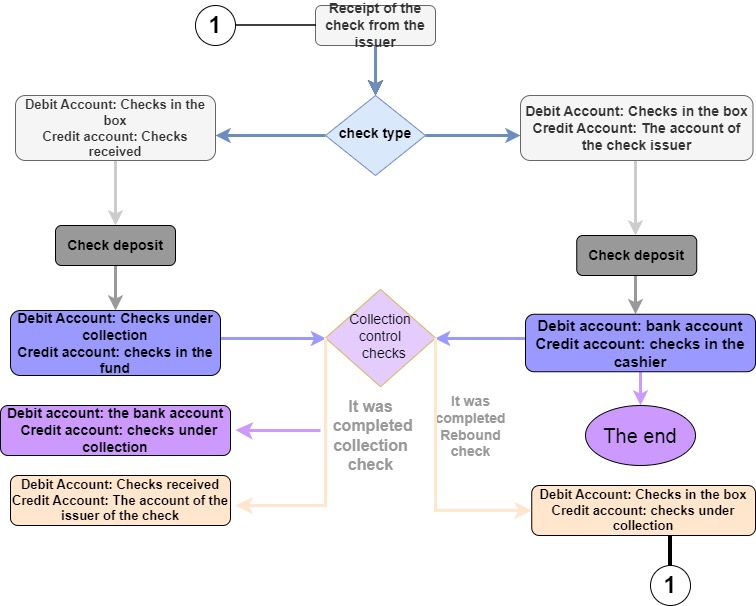

- Controlling disbursement operations by going through the following stages at each disbursement process :

- Issuing a disbursement note (payment order) to the beneficiary.

- Review the disbursement memorandum (payment order) by an authorized user.

- Disbursement approval for the disbursement memorandum (payment order).

- Editing and printing the bill of exchange.

All previous stages include all types of cash exchange notes, checks, and bank transfers. It must also be emphasized that the majority of these exchange notes are issued automatically by the system from their sources in other systems.

- The issuer’s account balance for a received check is not affected unless it is a cashier’s check or after collection has been confirmed for the check.

- Performing daily, weekly, or monthly reconciliations between bank statements issued by the bank and bank statements issued by the system, with the addition of the possibility of linking it with the banking system.

- Exchange voucher programs directly affect the beneficiary’s account or all types of expense accounts according to the wishes of the person entering the exchange voucher.

- The system contains an ideal financial treatment for revaluing bank accounts in foreign currencies and the effects of this treatment on issuing automated accounting entries.

Check collection course

Payments cycle

Data flow in the bank, fund and covenant accounts system

(cash flows)